AI in Logistics: Emerging Startups, Challenges and Use Cases [UPDATED 2024]

The drivers behind innovation in logistics and key players.

![AI in Logistics: Emerging Startups, Challenges and Use Cases [UPDATED 2024]](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/ai_in_logistics_emerging_startups_2024_71afef795f.webp?fit=x1200,x800,x400,x256/width=2400)

In the ecosystem of logistics and supply chain management, the integration of AI promises a major shift in operations, poised to reshape the industry: the input - by changing the way raw material are acquired and transported to manufacturers, and the distribution - by transforming how products get from manufacturer to the end consumer via changing distribution strategies, customer engagement, and after-sales services.

In this report, we explore how AI has become the cornerstone of agile, data-driven logistics ecosystems, reducing costs and environmental impact, and boosting customer satisfaction. This is an updated version of our previous report, that continues to explore the uses of AI in logistics, emerging players and models, recent VC deals and exits as well as a path forward for the industry.

The Global AI in Logistics and Supply Chain Market Ecosystem was valued at $3B in 2022 and is expected to reach $64B in 2030, growing at a CAGR of 46.5%

According to a different source, just the global generative AI in logistics portion of it was estimated at $491M in 2022 and it is expected to hit around $18B by 2032, expanding at a CAGR of 44%

The key drivers behind rapid AI adoption include:

- Rising requirements for flexibility (specific pick-up points and time slots), quicker deliveries (hours not days), request for inclusivity, standardization, and sustainability.

- The requirement for transparency and end-to-end visibility across the supply chain.

- Increased availability of more structured data, new AI frontiers (GenAI), and advanced data analytics technologies.

- Expectations of future market volatility prompt diversification and continuity strategies that allow to react and adapt to supply chain shocks.

- Finally, there is always the question of pricing powered by general expectations of lower costs that put pressure on company margins and push them toward labor automation.

While there is certainly a lot of hype around AI applications in logistics and supply chain, there is also an ongoing debate about the extent of such applications as well as potential drawbacks such as mass unemployment, privacy, and integrity concerns. Before turning to risks and challenges, let’s first look at how exactly companies leverage AI to enhance their process or create new applications altogether.

Main AI Trends and Applications in Logistics & Supply Chain Management

Traditional tech and new AI techniques in computer vision, machine and deep learning, and natural language processing continue to open new pathways to effectively manage complex decision-making and operations. The AI innovation in logistics can be grouped into the following cohorts:

- Automation of processes and tasks:

- Back-office automation: automating repeatable tasks like form completion, invoicing, and inventory check-ups.

- Brokerage automation: accelerating complex brokerage process susceptible to human error and requiring specific regulations knowledge.

- Data collection and storage: keeping client records up-to-date.

- Prediction and forecasting for processes optimization:

- Dynamic routing: adjusting delivery routes based on real-time data like traffic, weather, as well as geospatial data to improve on-time delivery.

- Multi-Modal optimization: determining the most efficient mix of transportation modes (such as trucks, trains, ships, and drones) to optimize complex logistics networks.

- Predictive analytics: forecasting demand, inventory levels, fuel usage.

- Equipment maintenance: forecasting wear and tear of machinery.

- Demand forecasting: leveraging historical and real-time data to predict demand for route planning and resource allocation.

- Sustainability initiatives: reducing carbon footprint by optimizing routes.

- Dynamic pricing: setting the optimal price based to increase the company’s bottom line.

- “AI-Driven Computer Vision” - logistics companies benefit from tech advancements in depth perception, 3D reconstruction, and enhancement of obscure and blurry images:

- Health and Safety: identifying hazards in warehouses, depots, and other logistics facilities, thus preventing accidents.

- Operations: detecting bottlenecks and inefficiencies via heat maps for identifying workflow patterns, unauthorized entry or intrusion.

- Asset management: monitoring and alerting maintenance teams, identifying asset flaws, and anomalies, and simplify defect detection.

- Loading and shipment processing: automating and simplifying the dimensioning process in shipping, calculating storage capacities, load planning, transportation logistics, and shipment billing, reducing the number of trips required.

- Autonomous Vehicles:

- Effective operations: self-driving trucks with better efficiency, cost, safety, and reliability.

- Last-mile delivery: autonomous drones and ground vehicles for efficient last-mile delivery.

- Generative AI (GenAI) - creates fresh content like text, audio, video, and more using large datasets for training where output quality depends on both the training data and user-provided prompts:

- Supplier selection and procurement: GenAI can provide a detailed supplier assessment and create an optimal supply list based on cost-effectiveness, product quality, reliability, and sustainability.

- Supply chain risk mitigation: GenAI can aid in scenario-based risk assessment by creating disruption models, including situations like supplier insolvency, wars, strikes, natural disasters, and pandemics. This ongoing analysis enables companies to develop resilient strategies for business continuity.

- Procurement and inventory accuracy: beyond demand prediction, GenAI can create flexible inventory policies, optimizing costs by suggesting just-in-time inventory management strategies, cutting storage expenses, and improving cash flow.

- Logistics coordination: GenAI can formulate contingency plans for disruptions like traffic congestion or extreme weather conditions. When provided with specific constraints, GenAI can design optimal storage and picking layouts for warehouses.

- Customer support: chatbots and Intelligent Virtual Assistants can provide order statuses, and estimated delivery times, and address inquiries or complaints by voice or text. Chatbots can also facilitate valuable analytics metrics, enabling the company to better understand customer needs and enhance the customer experience.

This is not an exhaustive list and as AI adoption continues and new models and tools emerge, we will see new applications as well as more granular approaches to existing ones.

Incumbent players’ AI adoption

How established players in logistics leverage AI.

While there is a lot of innovation coming from startups, established players strive to ride the wave of AI and pioneer new approaches and solutions. Often advantaged by having vast pools of data and technical infrastructure and talent necessary to adopt AI, large enterprises like DHL and Hitachi are constantly in the headlines when it comes to adopting new technologies.

For example, at DHL, AI-powered sorting robots are becoming a game-changer, increasing sorting capacity by some 40% or more. DHL has partnered with Dorabot, an AI-powered robotic solution provider capable of sorting over 1,000 small parcels per hour with 99% accuracy. DHLBots reduce missorting, removing the need for secondary sorting. Their AI forecasting and prediction models, on the other hand, help DHL to know with 90%-95% certainty that specific volumes of shipments are going to arrive in a certain facility for this day.

FedEx has invested in the artificial intelligence platform Vue.ai to make smarter supply chains and become the single unifying AI platform for large enterprises to “build entire vertically integrated stacks that are relevant to their industry.” Earlier, FedEx and Microsoft partnered to develop AI tools for enhancing logistics aimed at improving visibility and decision-making in supply chain operations, using AI-driven predictive analytics and data insights.

Hitachi is using AI in a fusion with the Metaverse to enhance railway safety. By combining AI technologies with virtual environments, they create a realistic simulation of railway operations. This allows for effective training and testing of safety procedures and scenarios, helping railway operators and staff to improve their response to critical situations.

This summer, California regulators granted permissionn for Waymo and Cruise, autonomous vehicle companies affiliated with Google, to provide around-the-clock paid taxi services in San Francisco. These two companies have the largest presence in the state, with hundreds of vehicles operating in the city. Other notable players include Apple’s secretive self-driving Project Titan with approximately 50 cars on public roads in 2022 and Amazon's Zoox which has a fleet of around 100 vehicles. Uber customers in Metro Phoenix may now be matched with a Waymo vehicle, allowing riders to experience a fully autonomous ride, with no human driver behind the wheel.

At the same time, as China advances its Level 3 automation, where a vehicle can operate independently under specific conditions, Baidu's Apollo Go is at the forefront. In June, the company secured a license to operate its autonomous ride-hailing service commercially in selected areas of Shenzhen.

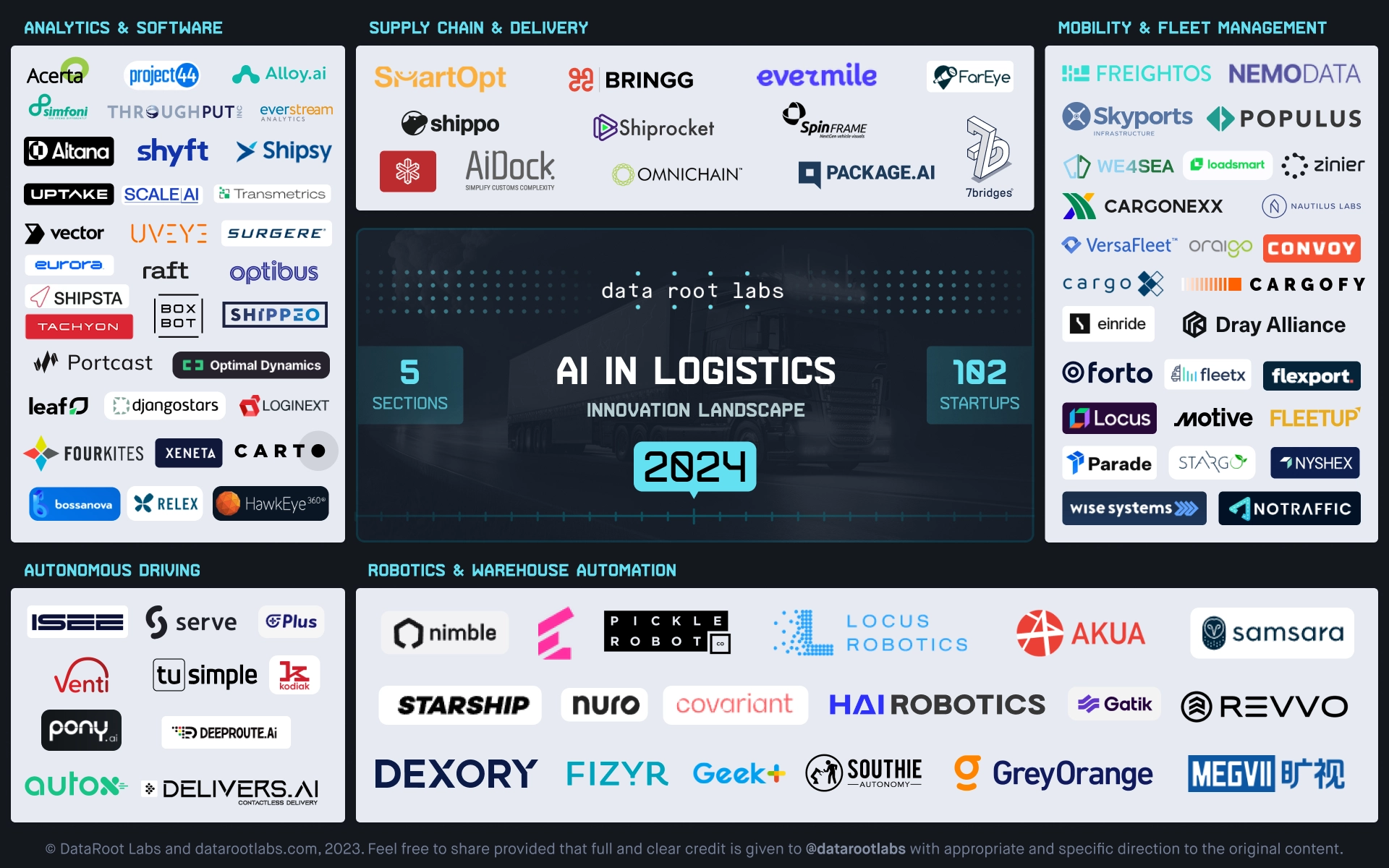

AI-Enabled Startups in the Global Logistics Industry

Innovation landscape of venture-funded startups in AI in Logistics.

According to Traxn, the funding in AI logistics companies in the past 2 years reached $5.1B with top geographies including the US, India, China, Germany, and the UK. We can confirm that despite the challenging investment market in the past 18 months, many early-stage companies initially featured in our 2020 report raised Series A and later fundraising rounds.

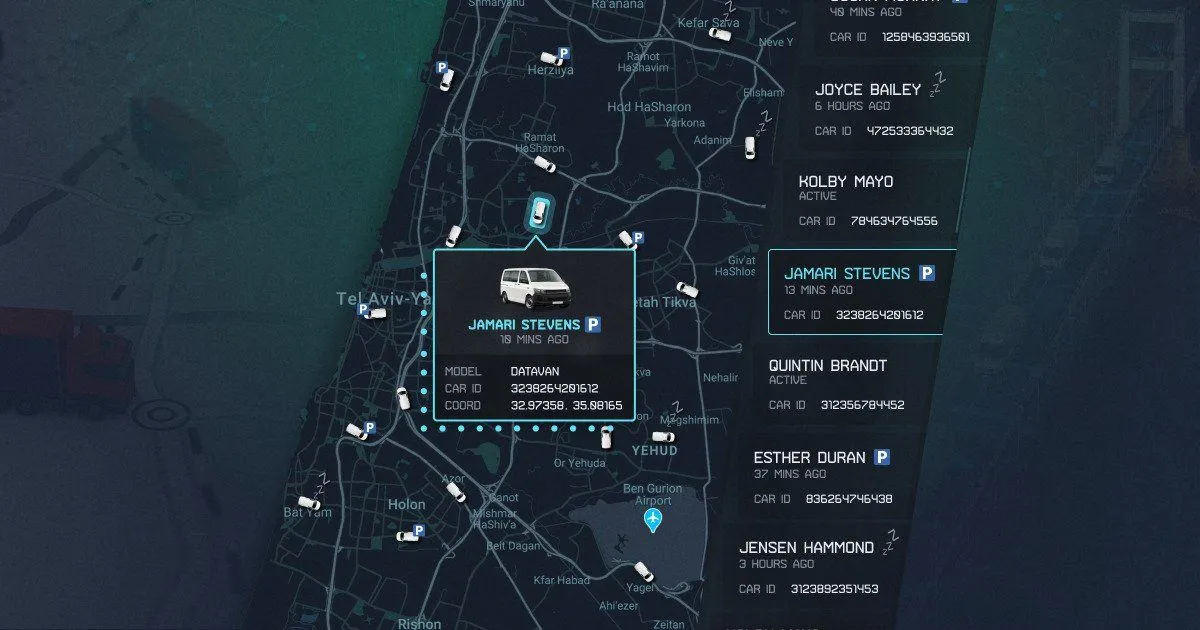

Every logistics tech startup carries a unique approach to AI, and some of them have already operationalized several use cases. Based on public information gathered from Crunchbase, Pitchbook, and other open sources, we have compiled a list of startups that bring AI to the global logistics and supply chain industry that constitute today's Innovation Landscape in AI in Logistics 2024.

Innovation Landscape — AI in Logistics 2024

Let’s look at each category one by one.

In Analytics & Software, Portcast provides real-time updates on ocean containers to enable shippers to predict cargo arrival times accurately and set the entire supply chain in motion, cutting down on port fees, and eliminating manual work and needless delays. Portcast accomplishes this using advanced data sets and proprietary machine-learning algorithms.

](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Portcast_e30fe2520e.webp?fit=x1200,x800,x400,x256/width=2400)

Real-time transportation visibility and predictive insights by Portcast

Shippeo provides real-time multimodal transportation visibility, helping major shippers and logistics service providers operate more resilient, sustainable, and customer-centric supply chains. Their Multimodal Visibility Network integrates with more than 1000 TMS, telematics, and ELD systems, enabling Shippeo’s platform to provide instant access to real-time shipment tracking across all transport modes. Their machine learning algorithm allows supply chain companies to quickly anticipate problems, proactively alert customers, efficiently manage exceptions with collaborative workflows, and accurately measure CO2 and GHG emissions from supply chain transport.

visibility platform.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Shippeo_64c3e49fef.webp?fit=x1200,x800,x400,x256/width=2400)

Shippeo’s visibility platform.

Transmetrics' AI-powered platform leverages advanced machine learning algorithms and data analytics to redefine supply chain planning. It integrates seamlessly with TMS, ERP, and asset management systems, resolving data quality issues and providing access to detailed historical reporting on operational performance. By leveraging historical data combined with relevant external factors, Transmetrics builds highly accurate and reliable forecasts that can help solve challenges related to capacity, volatility, and margins by leveraging predictive planning and becoming truly data-driven.

for logistics planning.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Transmetrics_12572b7883.webp?fit=x1200,x800,x400,x256/width=2400)

Transmetrics’ AI platform for logistics planning.

With many fleets short on drivers and technical staff, vehicle failures are often not addressable in a timely and cost-effective manner. Uptake allows companies to discover individual vehicle risk scores and assess global fleet health, flagging potential failures and informing replacement part inventory which helps to cut maintenance costs and increase driver mileage.

maintenance analytics platform.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/uptake_e5d01d68ef.webp?fit=x1200,x800,x400,x256/width=2400)

Uptake’s maintenance analytics platform.

In Autonomous Driving, companies like tuSimple, Gatik, and Kodiak developed autonomous trucks powered by AI/ML algorithms to make freight transportation safer, more efficient, and environmentally friendly. Kodiak, for example, is now being used to revolutionize ground autonomous military operations. Aside from its off-road driving capabilities, the Kodiak Driver drives, trusting its eyes, not its memory, just like human drive, using perceivable cues to place itself without relying solely on maps. This means that a Kodiak Driver-equipped military vehicle can drive based on satellite images alone without requiring a service member to drive a dangerous route to collect map data.

’s dual-use autonomous truck.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Kodiak_7d96f7b30f.webp?fit=x1200,x800,x400,x256/width=2400)

Kodiak’s dual-use autonomous truck.

AutoX' self-driving car is capable of handling the most challenging and dynamic traffic scenarios in urban cities around the world. AutoX obtained the world's second driverless RoboTaxi permit from California and was the first company in Shenzhen and Shanghai to operate a fully driverless RoboTaxi service on public roads without any safety driver, covering the world's largest driverless area.

’ driverless Robotaxi.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/autox_a983072614.webp?fit=x1200,x800,x400,x256/width=2400)

AutoX’ driverless Robotaxi.

In Fleet Management, for efficient last-mile delivery, Wise Systems developed Route Planner, a powerful, web-based application that calculates optimal routes, factoring in the unique variables and constraints. It enables dispatchers to optimize the delivery plan for static, dynamic, or hybrid routing. The dispatcher also can customize route zoning, on-demand orders, and time windows in real-time.

’s Route Planner.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/wise_systems_9f015932c2.webp?fit=x1200,x800,x400,x256/width=2400)

Wise System’s Route Planner.

Using Freightos, the world’s largest online freight marketplace, small and midsized importers can seamlessly compare, book, and manage shipments, making freight as easy as booking tickets online. The Freightos Marketplace helps importers and exporters reduce logistics spending and save time with instant comparison, booking, and management of air, ocean, and land shipments from top logistics providers.

’ online freight marketplace.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Freightos_96dab3d3fb.webp?fit=x1200,x800,x400,x256/width=2400)

Freightos’ online freight marketplace.

To improve parking, and rider behavior and enable better policies, Populus empowers cities with data from shared fleets of bikes, scooters, mopeds, and cars by obtaining insights on parked vehicles and trip patterns. They also developed a Curb Manager solution for cities to measure demand, digitize parking regulations, and actively manage their curbs.

In Robotics & Warehouse Management, Southie Autonomy provides contract packagers, manufacturers, and retailers with fast and flexible robot arm automation for easy packaging assembly, kitting, and palletization. Their no-code, no-programming software platform makes it easy for any worker to deploy and changeover robot arms in less than 10 minutes.

for Co-Packers.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Southie_R_fb5b9e7d9c.webp?fit=x1200,x800,x400,x256/width=2400)

Southie Codiac robot for Co-Packers.

Starship Technologies builds fleets of self-driving delivery robots designed to deliver goods locally within 30 minutes. The robots drive autonomously 99% of the time to make safe and environmentally friendly curb-side deliveries from a local hub. Delivering items such as groceries, food takeaways, and packages, Starship now operates in over 60 locations across the world and has made over 5 million autonomous deliveries to date.

To provide real-time visibility of inventory and warehouse operations, Dexory offers the only system that combines stock-scanning robots with powerful warehouse analytics. It can scan up to 15,000 locations an hour with 99.9% inventory accuracy to achieve optimal occupancy and reduce shrinkage & consistently hit SLAs.

’s stock-scanning robots for Maersk.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Dexory_adb0a1215c.webp?fit=x1200,x800,x400,x256/width=2400)

Dexory’s stock-scanning robots for Maersk.

Nimble designed a robotic system to provide automated end-to-end piece-picking, sorting, and packing solutions for e-commerce orders allowing companies to optimize warehouse locations, inventory placement, transportation strategies, and end-to-end logistics. Nimble's AI technology has picked, packed, and handled millions of items across apparel, health and beauty, footwear, electronics, consumer packaged goods, general merchandise, pharmaceuticals, and more.

's next-gen AI.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Nimble_37c2fc3bfc.webp?fit=x1200,x800,x400,x256/width=2400)

Robotic fulfillment centers powered by Nimble's next-gen AI.

In Supply Chain Management, companies like Bringg and Fareye focus on solving last-mile delivery challenges to reduce costs simplify operations, and drive brand loyalty.

When damage inspections are non-systematic and manual, they result in millions of dollars in claims each year, harming the relationship between ports, car importers, and dealers. To solve that problem, Spinframe develops vehicle inspection systems based on AI, computer vision, and machine-learning technologies that detect anomalies from the assembly line throughout the vehicle journey to the dealership and end customer. Through the Spinframe platform, you can view the fleet's condition in real-time and see a timeline of the vehicles' physical condition history.

Another player worth mentioning is a Canadian accelerator and innovation cluster Scale AI, which helps supply management companies enhance their AI-based product and service offerings and assists with AI go-to-market strategies. They have invested over $500M by reimbursing up to 50% of expenses for approved projects that target the adoption or commercialization of AI for the supply chain. All projects must be executed in Canada.

In Warehouse Automation, Hai Robotics aims to empower every warehouse and factory with logistics robots. The HaiPick solution is the world's first autonomous case-handling robot (ACR) system. It intelligently identifies desired totes and cartons, rather than the entire rack, and autonomously brings them to the workstation. HaiPick can increase warehouse operation efficiency by three to four times and storage density by 80% to 400% for clients globally.

A42 Autonomous case handling robot ACR.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Hai_Pick_9f7c259e9b.webp?fit=x1200,x800,x400,x256/width=2400)

HaiPick A42 Autonomous case handling robot ACR.

Locus Robotics manufactures autonomous, mobile robots to support e-commerce operations for retailers and warehouse logistics providers. Its technology works collaboratively alongside workers to dramatically improve order productivity and increase fulfillment speed and throughput 2X-3X with near-perfect order accuracy. Locus eliminates unproductive walking time to significantly improve productivity and lower cycle times. Locus also improves workplace ergonomics and health safety and also helps with worker recruiting and retention.

autonomous robots.](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Locus_7bb65eb8ed.webp?fit=x1200,x800,x400,x256/width=2400)

Locus Robotics autonomous robots.

In the table below, we assembled a list of startups that recently raised capital and are players ‘to watch’ poised for success.

| Company | HQ / year founded | Amount Raised, $ | Investors | What they are doing |

| 7bridges | UK / 2014 | $20.4M A | Maersk Growth, Crane Venture Partners | Developer of a logistics engine optimization platform designed to automate the workflow of the logistics industry. |

| Acerta | Canada / 2017 | $18.6M B | OMERS Ventures, Techstars, M12, BDC Venture Capital | Acerta is an ML-based failure prediction software solution. It is augmenting technical know-how with machine learning to uncover actionable insights from vehicle and production data. They are helping automakers get complex products to market faster and with fewer defects, amplifying domain knowledge with artificial intelligence to locate the earliest indicators of future product failures. |

| AiDock | Israel / 2018 | $7.5M A | The Carlton James Group, The Dock Innovation Hub | AiDock is creating the future of the supply-chain service providers by automating all paperwork-related tasks in the export and import of goods, leading the AI revolution in the supply chain and logistics industry. |

| AKUA | US / 2015 | $3M A | Crosslink Capital | AKUA is a subscription data service delivering actionable, real-time, and secure business intelligence directly to cargo owners. Their flexible IoT platform provides persistent environmental monitoring and tracking solutions for intermodal cargo containers with no new equipment to buy or manage. |

| Alloy | US / 2017 | $15.3M A | Menlo Ventures, 8VC | Alloy equips consumer goods brands to capture demand and streamline supply by breaking down silos within and across the supply chain, sales, and marketing teams. Their cloud platform couples end-to-end inventory and shipment visibility with sell-in and sell-through analytics to surface relevant insights in real-time. |

| Altana | US / 2018 | $122M B | Prologis Ventures, Reefknot Investments | Operator of a global supply chain platform intended to offer trade data management services. |

| AutoX | US / 2016 | $160.1M B | Dongfeng Motor Group, Hongzhao Fund | AutoX is a self-driving car startup that is building the hardware + software integrated full stack technology for Level-4 AI driver. The same AutoX driver can drive different vehicles, including RoboTaxi and RoboTruck. AutoX aims to empower the world with their AI driver to provide universal access to transportation of people and goods, safely and reliably. |

| Bossa Nova Robotics | US / 2005 | $97.8M Debt Financing | Cota Capital, Paxion Capital Partners, Celesta Capital | A real-time, on-shelf product predictive analytics provider for the global retail industry. Its technology collects terabytes of data that enables the retail ecosystem to optimize the omnichannel shopping experience. |

| Boxbot | US / 2017 | $17.5M A | Artiman Ventures | Automation technology for first, middle, and last mile facilities that enables faster and less expensive e-commerce delivery. Boxbot's intelligent sorting platform consists of a unique Automated Storage and Retrieval System (AS/RS) combined with proprietary software called the Boxbot Sorting Execution System. |

| Bringg | Israel / 2013 | $184M E | Insight Partners, Next47, Aleph, Viola Growth, O.G. Venture Partners, Cambridge Capital | Bringg is a delivery logistics solution providing enterprises with an efficient way to manage their complex delivery operations. Their SaaS-based platform offers real-time capabilities to achieve logistical excellence across delivery ecosystems via streamlining logistical operations for peak efficiency and creating perfect delivery experiences for their customers. |

| Cargofy | US / 2017 | $3M Seed | JKR Investment Group, ISA Fund, Lair East Labs, Quake Capital Partners, Superangel, F1V | Cargofy is the easiest way to find loads for independent truckers. The company helps truckers access high-paying loads through a mobile app, truck navigator, and receive discounts on fuel, maintenance, and truck parts. |

| Cargonexx | Germany / 2016 | - | EIT Digital | Cargonexx is the first digital freight forwarder to use AI to reduce empty runs. The young Hamburg-based company has already built up a network of over 100,000 trucks. Cargonexx was awarded as the best mobility start-up in Europe and won numerous prizes, including the German Digital Prize by McKinsey. The company has developed state-of-the-art ML algorithms to predict unused capacity. |

| CargoX | Brazil / 2013 | $390.1M F | Goldman Sachs, Tencent, Blackstone Group, Lightrock, SOFTBANK Latin America Ventures, Pattac | A technology-powered freight broker that provides shippers with an efficient solution to transport the most diverse types of products in any part of Brazil. The service is based on a technology that has a growing fleet of 100,000 truckers. Through technology, they connect over 10 thousand shippers with 1.4 million trucks to eliminate excess capacity. CargoX saves on shipping costs for shippers, increases earnings for truckers, and reduces C02 emissions generated by empty trucks on the road. |

| Carto | US / 2012 | $94M C | Accel, Earlybird, Insight Partners, European Innovation Council, Plug and Play | CARTO is a platform that turns spatial data into efficient delivery routes, better behavioral marketing, and strategic store placements. Their team solves spatial problems using CARTO’s data and analysis to understand where and why things happen, optimize business processes, and predict future outcomes through the power of Spatial Data Science. |

| Convoy | US / 2015 | $1.1B Debt | Y Combinator, Greylock, T. Rowe Price, JP Morgan, Baillie Gifford, BloombergNEF, CapitalG, Generation Investment Management | A marketplace that connects shippers with nearby trucks (‘carriers’) and books jobs instantly. Convoy is the most efficient digital freight network. They use technology and data to solve problems of waste and inefficiency in the $800B trucking industry, which generates over 76M metric tons of wasted CO2 emissions from empty trucks. |

| Covariant | US / 2017 | $222M C | Index Ventures, Amplify Partners, Radical Ventures | Covariant is a developer of artificial intelligence for robotics which is building the Covariant Brain, a universal AI to give robots the ability to see, reason, and act on the world around them. They are bringing the Covariant Brain to commercial viability, starting with the industries that make, move, and store things in the physical world. |

| DeepRoute | China / 2019 | $350M B | Yunqi Partners, Fosun RZ Capital, Jeneration Capital | Deeproute is an international self-driving technology company committed to advancing urban logistics and popularizing robotaxis. |

| Delivers.AI | Turkey / 2020 | $1.2M — | Driventure, hi VC, StartupFon | Developer of robots designed for food and grocery deliveries. The company's product combines the latest next-generation navigation technology with an appealing design, enabling users with human-free interactions for food ordering and delivery.

|

| Dexory | UK / 2015 | $38M A | Atomico, Lakestar, Capnamic Ventures, Kindred Capital | Developer of autonomous mobile and modular robots that measure, track, and find goods across warehouses without workflow disruption and provide real-time data at every stage of the process. |

| Django Stars | US /2008 | — | — | Django Stars is a technical partner for logistics businesses to seamlessly build, modernize, and maintain their software products. From optimized dispatch and routing to real-time data capture and analytics, Django Stars design transportation management systems that equip businesses with advanced capabilities for cost reduction, better expenses management, and efficient routine automation. |

| Dray Alliance | US / 2017 | $55.1M Non Equity Assistance | Plug and Play, Matrix Partners, Headline, Craft Ventures, JP Morgan, Wonder Ventures | Dray Alliance is an AI-enabled online marketplace for container drayage services in & around Los Angeles and Long Beach. Enables users, freight forwarders, and import/export shippers to book drayage services from multiple operators on the platform, via an AI-enabled quoting system. |

| Einride | Sweden / 2016 | $652.3M C | Plug and Play, EQT Ventures, Barclays Corporate Banking, Norrsken VC, BUILD Capital Partners | Einride is a cargo and freight company that designs and builds technologies for transportation systems. It is taking logistics in a new direction with intelligent freight mobility solutions that are both autonomous and electric for shippers and carriers. |

| Evermile | UK / 2022 | $6M Seed | Mensch Capital Partners, 10D | Evermile is the first delivery platform built for local businesses. Powered by AI and optimization, we're on a mission to help millions of local businesses thrive by simplifying and optimizing their business and operations. |

| Everstream | Germany / 2012 | $79M B | Columbia Capital, StepStone Group, Morgam Stanley Investment Management | Developer of a supply chain risk management platform designed to leverage machine learning and Artificial intelligence AI to predict, assess, and mitigate the risk of supply chain disruptions. |

| FarEye | India / 2013 | $150.7M E | TCV, M12, Dragoneer Investment Group, Elevation Capital, Fundamentum, KB Global Platform Fund, Deutsche Post | FarEye is a logistics SaaS platform for predictive visibility. It enables brands to orchestrate, track, and optimize their logistics operations. The machine-learning-based platform is empowering global enterprises to shrink delivery time by up to 27%, increase courier productivity by up to 15%, eliminate risks by up to 57%, and achieve operational excellence. |

| Fizyr | The Netherlands / 2014 | $4.44M Growth | Value Creation Capital | Fizyr enables the automating of human tasks in logistics using AI. Fizyr designs, builds, installs, and maintains the world’s best vision software product for automated picking and placing in harsh logistics environments. Their deep learning algorithms are used to enable automated handling of unknown objects varying in shape, size, color, material, and stacking, being picked from (conveyed) bulk. |

| FleetUp | US / 2013 | $25M Growth | Humax Holdings | FleetUp provides a Total Mobility - transportation fleets, assets, equipment & operators - Management System (MaaS) with a single uniform but scalable cloud platform that incorporates machine learning & data analytics. |

| Fleetx.io | India / 2017 | $26.1M B | IndiaMART, BEENEXT, India Quotient, LetsVenture, First Cheque | Fleetx is an intelligent fleet and logistics management platform that uses AI, machine learning, sensors, and predictive analytics to help fleet owners and manufacturers improve their logistics operations with efficiency, safety, and make smart and better decisions in a cost-effective and flexible way. Fleetx’s operation system for logistics helps customers reduce operations costs by up to 8-10% with real-time P&L visibility. |

| Flexport | US / 2013 | $2.4B Growth | Andreessen Horowitz, Founders Fund, SoftBank Vision Fund, Kohlberg Kravis Roberts, DST Global, Shopify, S.F. Express, MSD Partners | Flexport is a licensed customs brokerage and freight forwarder built around a modern web application. Its freight service includes an online dashboard for businesses to easily understand, purchase, manage, and track the services required for global trade. Its team of logistics experts focuses on core business by ensuring goods arrive at fulfillment/distribution centers on time and at the lowest cost. |

| Forto | Germany / 2016 | $593.4M D | Global Founders Capital, SoftBank Vision Fund, Northzone, Cherry Ventures, Unbound, Inven Capital, Rider Global, Disruptive | Forto is a digital freight forwarder and a digital interface to manage user logistics. It features past, current, and future freight shipments, keeps track of missing documents, uploads all files stores them for future use, and offers real-time freight tracking. |

| Fourkites | US / 2014 | $241.5M Growth | Bain Capital Ventures, August Capital, Hyde Park Venture Partners, Mitsui & Co, CEAS Investments, Thomas H. Lee Partners, FedEx | FourKites tracks and consolidates data across modes – including ocean, rail, parcel, and over-the-road, with both truckload and less-than-truckload – into a unified platform built for global enterprise companies. With the world’s largest network of shippers, carriers, and 3PLs, FourKites delivers unprecedented levels of insight — enabling you to make better, more proactive supply chain decisions. |

| Freightos | Hong Kong / 2012 | $118.3M C | GE Ventures, Aleph, MoreVC, Annox Capital, Singapore Stock Exchange | Using Freightos, the world’s largest online freight marketplace, small and midsized importers can seamlessly compare, book, and manage shipments, making freight as easy as booking tickets on Expedia. The Freightos Marketplace helps importers and exporters reduce logistics spending and save time with instant comparison, booking, and management of air, ocean, and land shipments from top logistics providers. Freightos also provides patent-pending technology that empowers carriers and logistics providers around the world to automate freight sales. |

| Gatik | US / 2017 | $122.9M B | Innovation Endeavors, Koch Disruptive Technologies, Wittington Ventures, Government of Ontario | Gatik creates autonomous solutions to tackle expensive urban logistics for businesses. Focusing on B2B goods delivery, Gatik uses Level 4 automated light trucks and vans to ensure goods are transported efficiently and affordably in city environments between business locations. |

| Geek+ | China / 2015 | $539.4M E | GGV Capital, Vertex Ventures, Warburg Pincus, D1 Capital Partners, CPE, Volcanics Venture, V Fund Management, Banyan Capital Partners | Geek+ is a global leader in robotic solutions for logistics. They develop Autonomous Mobile Robot (AMR) solutions to realize flexible, reliable, and highly efficient automation for warehouses and supply chain management by automating various laborious tasks like picking, moving, and sorting. |

| GreyOrange | US / 2011 | $293.1M Growth | Tiger Global Management, Blume Ventures, InnoVen Capital, Mithril Capital Management, BITS Spark Angels | GreyOrange modernizes order fulfillment through AI-driven software and mobile robots built to cooperate in deciding on and executing warehouse activities that maximize payoffs and minimize tradeoffs to create the highest yield. The company’s fulfillment operating system GreyMatter considers predictive and real-time data regarding orders, promises, inventory, shipping windows, and resources to orchestrate how workers and robots work together to fulfill the right orders at the right time. |

| HAI ROBOTICS | China / 2016 | 285M D | HSG, Walden International, Source Code Capital, others | Manufacturer of robotics and artificial algorithms intended for apparel, retail, grocery, healthcare, electronics and automotive industries. The company's warehousing technologies leverage artificial intelligence and robotic technology to improve warehouse functions, enabling warehouse operators to improve working efficiency and automate storage functions. |

| HawkEye360 | US / 2015 | $362.3M D | Esri, Airbus, Raytheon, NightDragon, Allied Minds, Razor's Edge Ventures, Seraphim Space, BlackRock, Insight Partners | HawkEye 360 is a data analytics company that develops space-based radio frequency mapping. The company operates a commercial satellite constellation to identify, process, and geolocate a broad set of RF signals. Its products include maritime domain awareness and spectrum mapping and monitoring. |

| ISEE | US / 2016 | $57.7 M | Jeneration Capital, MESH | Developer of an artificial intelligence-based automotive platform designed to create an intelligent autonomous driving system. |

| Kodiak Robotics | US / 2018 | $244.9M Grant | Battery Ventures, U.S. Department of Defense, BMW i Ventures, Horizon Technology Finance, Bridgestone Americas | Kodiak Robotics is an autonomous technology company redefining the long-haul trucking industry. Trucking will see the first widespread adoption of self-driving technology, ultimately saving lives, increasing network efficiency, reducing costs and emissions, and enhancing the quality of life of truck drivers. |

| Leaf Logistics | US / 2017 | $58.5M B | Sozo Ventures, Playground Global, Floodgate | Leaf Logistics is a data-driven technology to plan, coordinate, and execute transportation logistics. Leaf's freight contracting platform is an end-to-end solution for buyers and sellers to secure future transportation capacity, rates, and service through binding, tradeable Leaf Forward contracts. Using predictive analytics and AI, Leaf enables members to quickly identify the best contracting opportunities for their network, lowering costs and improving operations. |

| Loadsmart | US / 2014 | $346.4M D | Maersk Growth, Softbank, BlackRock, Inc., Connor Capital SB, Chromo Invest, TFI International | Transforming the future of freight, Loadsmart leverages artificial intelligence, machine learning and strategic partnerships to automate how freight is priced, booked and shipped. Pairing advanced technologies with deep-seated industry expertise, Loadsmart fuels growth, simplifies operational complexity and bolsters efficiency for carriers and shippers alike. |

| Locus | India / 2015 | $78.8M C | Tiger Global Management, GIC, Alpha Wave Global, Exfinity Venture Partners | Locus is an intelligent logistics automation and decision-making platform that comes with in-built route planning and vehicle allocation engine which improves consistency and efficiency of operations. The product suite comprises of a route deviation engine, order dispatch automation, a field user app, route optimizations, scheduling, tracking for end-customer, and predictive analytics. |

| Locus Robotics | US / 2014 | $416M F | Tiger Global Management, Scale Venture Partners, Goldman Sachs Asset Management, Bond, G2 Venture Partners | A warehouse robotics company that manufactures autonomous, mobile robots to support e-commerce operations for retailers and warehouse logistics providers. Locus Robotics manufactures autonomous, mobile robots to support e-commerce for retailers and warehouse logistics providers. Its technology works collaboratively alongside workers to dramatically improve order productivity and increase fulfillment speed and throughput 2X-3X with near-perfect order accuracy. |

| LogiNext | US / 2014 | $49.5M B | Tiger Global Capital, Steadview Capital Management, Alibaba Group | LogiNext is a global technology and automation company focusing on transportation, home deliveries, omnichannel fulfillment, and B2B distribution. Growing at an average rate of 150% YoY, LogiNext has helped its clients digitize and optimize order scheduling, customer communication, routing, dispatching, and real-time tracking to reduce logistics costs and achieve operational excellence. |

| Matternet | US / 2011 | $74M B | Mercedes-Benz Group AG, McKesson Ventures, Boeing HorizonX Ventures | Matternet builds and operates drone logistics networks for transporting goods on demand, through the air, at a fraction of the time, cost, and energy of any other transportation method used today. The company has partnered with UPS to make unmanned drone deliveries for medical samples. |

| Megvii | China / 2011 | $1.4B D | Qiming Venture Partners, Ant Group, Foxconn Technology Group, Bank of China Group Investment, Foxteq Holdings | Megvii has created an AIoT product system that integrates hardware and software solutions catering to three core applications: Consumer IoT, City IoT, and Supply Chain IoT. The solutions are widely used in internet, finance, cities, transportation, real estate, logistics, and other fields, helping the intelligent upgrading of the industry and the commercialization of AI. |

| Motive | US / 2013 | $567.3M F | Kleiner Perkins, Index Ventures, Insight Partners, IVP, Scale Venture Partners, ITOCHU Corporation, Greenoaks, G2 Venture Partners | Motive developed an electronic fleet tracking platform designed to digitize long-haul trucking services. Improved communication with drivers and real-time GPS tracking provide accurate delivery windows and prevent delivery disputes. Advanced AI detection models instantly recognize unsafe driving actions like cell phone use and close following. Audio and visual dash cam alerts remind drivers to improve in real time. |

| Nautilus Labs | US / 2016 | $47M B | Techstars, M12 - Microsoft's Venture Fund, BloombergNEF, Root Ventures, Microsoft Climate Innovation Fund | Nautilus is building artificial intelligence to advance the efficiency of ocean commerce. They deliver technology to help shipping companies minimize fuel consumption, maximize operational efficiency, and optimize fleet performance. By arming ship owners and operators with real-time predictive decision support, Nautilus is reducing greenhouse gas emissions and making global trade sustainable. |

| New York Shipping Exchange (NYSHEX) | US / 2014 | $68.9M B | GE Ventures, GS Growth, NewRoad Capital Partners, Collate Capital | NYSHEX is the digital infrastructure for global shipping. The platform unites shippers, carriers, and forwarders with a reliable, efficient, and trusted system for global commerce. New York Shipping Exchange enables the transformation of the container shipping industry through two innovations: a new standardized freight contract and a new way to trade freight digitally. |

| Nimble Robotics | US / 2017 | $115M B | Cedar Pine, GSR Ventures | Designer of a robotic system created to provide automated end-to-end piece-picking, sorting, and packing solutions for eCommerce orders. |

| NoTraffic | Israel / 2016 | $75.7M B | Grove Ventures, Nextgear Ventures, Vektor Partners | Developer of an autonomous traffic management platform designed to reduce traffic congestion. |

| Nuro | US / 2016 | $2.1B D | Tiger Global Management, Greylock, SoftBank Vision Fund, T. Rowe Price, Gaorong Capital | NURO is a technology company that creates self-driving delivery vehicles that can make deliveries and transport goods without the help of a driver. |

| Omnichain | US / 2016 | $3M Venture Round | Global Brain Corporation | Omnichain provides forward and reverse intelligent supply chain management software. It connects disparate stakeholders through distributed ledger technology, creating a connectivity layer for in-house AI and ML models to run predictive analytics and execution. The result of this is holistic orchestration, transparency, and proactive decision-making across the supply chain. |

| Optibus | Israel / 2014 | $260M D | Volvo Group Venture Capital, Bessemer Venture Partners | Optibus is a developer of an AI-enabled SaaS platform for planning and running mass transportation. |

| Optimal Dynamics | US / 2017 | $55.8M B | Bessemer Venture Partners, Fusion Fund, The Westly Group, Fitz Gate Ventures | Optimal Dynamics’ main product, CORE.ai, leverages High Dimensional Artificial Intelligence, the result of decades of research and development at Princeton University. Optimal Dynamics brings next-generation AI to the logistics industry, building to be the "Decisions Layer of Logistics". It enables logistics companies to automate and optimize their operations. |

| Oraigo | Italy / 2019 | $1.2M / Pre-Seed | – | Creators of a road safety technology solution, Oraigo is developing an ecosystem based on brain-computer interface technology, alongside mobile and web applications. The company harnesses advanced, patented technologies, incorporating precise statistical models, proprietary datasets and artificial neural networks. This system is adept at monitoring and actively detecting brain patterns, providing critical interventions against driving drowsiness and microsleep events. |

| Package.ai | Israel / 2016 | — Seed | ICONYC Labs, AltaIR Capital | A software and AI for optimizing last-mile delivery operations and experiences. package.ai has developed Jenny, a conversational agent that can contact parcel recipients via Facebook Messenger or SMS to coordinate delivery times, locations, and other specialized instructions. Powered by conversational AI, workflow automation, and last-mile intelligence, package.ai allows brands to effectively take charge of customer engagement across channels and journeys. |

| Parade | US / 2015 | $18.4M A | Menlo Ventures, Jones Capital, Greenhawk Capital | Parade is the leading capacity management platform for freight brokerages. Parade uses natural language processing and data analytics to address a particularly knotty problem: the volume of time-sensitive messages flooding in from truckers looking for loads. |

| Pickle Robot | US / 2018 | $37.5M A | JS Capital, Toyota Ventures | Developer of a package-handling robot designed to automate key tasks. The company's robot automizes key package handling tasks along the e-commerce supply chain such as loading and unloading feeder trucks, palletizing and depalletizing mixed parcels, preloading last-mile delivery vans, and package cars, and sorting, enabling logistics companies to save time and money.

|

| Plus | US / 2016 | $520M C | Sequoia Capital China, GSR Ventures, ClearVue Partners, FountainVest Partners, Guotai Junan International, CPE Capital, Wanxiang International Investment | Plus AI is developing self-driving technology for trucks. They have developed 2 lines of technology called PlusDrive® and SuperDrive™. |

| Pony.ai | US / 2016 | $1.2B Corporate Round | Sequoia Capital, Eight Roads Ventures, Legend Capital, 5Y Capital, Ontario Teachers' Pension Plan, KUNLUN, ClearVue Partners, Toyota Motor, GAC Toyota Motor | Pony.ai is a startup that builds full-stack autonomous driving solutions.

Using the power of their core technology “virtual driver”, they have positioned themselves at the forefront of autonomous driving across three business units: Robotaxi, Robotruck, and Personally Owned Vehicles (POV). |

| Populus | US / 2017 | $19.9M A | FootPrint Coalition, Zero Infinity Partners | Populus is a platform for cities to manage and price commercial fleets to deliver safer and more sustainable streets. |

| Portcast | Singapore / 2017 | $3.2M Seed | Wavemaker Partners, SGInnovate, Entrepreneur First, Newtown Partners, TMV, Innoport | Portcast is an AI-enabled visibility and analytics platform for global supply chains. The platform provides real-time updates on ocean containers to enable shippers to accurately predict cargo arrival times and set the entire supply chain in motion, cutting down on port fees, eliminating manual work and needless delays. Portcast accomplishes this using advanced data sets and proprietary machine learning algorithms. |

| project44 | US / 2014 | $763M / Growth | A.P. Moller Holding, Generation Investment Management, Goldman Sachs Asset Management, Thoma Bravo, TPG | As the supply chain connective tissue, project44 operates the world’s most trusted end-to-end visibility platform that manages more than 1 billion unique shipments annually for over 1,300 of the world’s leading brands, including top companies in manufacturing, automotive, retail, life sciences, food & beverage, CPG, and oil, chemical & gas. |

| Raft | UK / 2017 | $47.9M B | Moguntia Capital, Bessemer Venture Partners, Episode 1 | Developer of intelligent logistics platform designed to elevate the value of freight forwarding. |

| RELEX Solutions | Finland / 2005 | $804M PE Round | EASME, Summit Partners, TCV, Blackstone Group | RELEX is a cloud-based supply chain & retail enterprise resource planning software provider. It's a cloud-based supply chain planning tool for retailers based on AI & in-memory data processing technologies. |

| Revvo | US / 2018 | $10M Seed | Norwest Venture Partners, Cercano Management | Revvo provides a sensor-enabled AI - TireIQ™, a software platform to monitor vehicle tires to enable tire service providers, fleets, and individuals to take proactive action. |

| Roadstar.ai | China / 2017 | $140M Secondary | Shenzhen Capital Group, Wu Capital | Roadstar.ai is an AI startup that specializes in level 4 autonomous driving technologies. They focus on providing efficient autonomous driving solutions to future advanced transportation system using unique and robust multi-sensor fusion framework. |

| Samsara | US / 2015 | $930M Secondary | Andreessen Horowitz, General Catalyst | Samsara is an IoT platform that combines hardware, software, and cloud to bring real-time visibility, analytics, and AI to get a birds-eye view of your fleet - from light and heavy-duty vehicles to trailers and equipment -with real-time GPS tracking. |

| Scale AI | Canada / 2017 | $602.6M Debt | Government Of Quebec, Government of Canada | Scale AI is an industry-led consortium that shapes a new global supply chain platform. |

| Serve Robotics | US / 2017 | $53M — | Wavemaker Partners, Uber, NVIDIA | Serve is the future of sustainable, self-driving delivery. Their robots serve people in public spaces, starting with food delivery. |

| Shippeo | France / 2014 | $107.9M Venture Round | Bpifrance, Battery Ventures, Partech, NGP Capital, ETF Partners, Otium Capital, ORLEN VC | Shippeo is a global leader in real-time multimodal transportation visibility, helping major shippers and logistics service providers operate more resilient, sustainable, and customer-centric supply chains. This is made possible with highly accurate real-time operational visibility and Transport Process Automation™ to streamline transportation processes, reduce latency, and improve operational efficiency.

|

| Shippo | US / 2013 | $154.3M E | Bessemer Venture Partners, Union Square Ventures, Uncork Capital, D1 Capital Partners | Shippo is a multi-carrier shipping API and web app. E-commerce businesses, marketplaces, and platforms are able to connect to multiple shipping carriers around the world from one API and dashboard, through Shippo. Businesses can get shipping rates, print labels, automate international documents, track shipments, and facilitate returns. |

| Shiprocket | India / 2012 | $386.8M E | Temasek Holdings, Tribe Capital, March Capital, Lightrock, PayPal Ventures, Bertelsmann India Investments, Info Edge ventures, Nirvana Venture Advisors | Shiprocket is a provider of AI-based automated shipping management tools for e-commerce. Its platform allows users to import orders, select shipments and courier partners, pack orders and print labels, and track the order to inform customers. |

| Shipsta | Luxembourg / 2015 | $9.9M A | Tricap Investments | SHIPSTA’s Digital Freight Procurement Platform streamlines transportation procurement for global enterprises, taking a truly next-generation approach to freight procurement centered around data, automation & AI. By automating complex tasks and providing complete data transparency, it helps businesses to respond every day to market volatility, control freight costs and manage risk in their supply chain. |

| Shipsy | India / 2015 | $31.6M B | Surge, A91 Partners, Z3Partners | Shipsy is an enterprise SaaS company that helps its customers manage their end-to-end logistics across multiple modes like ocean, air and road transportation. Its mission is to create data-driven products to improve operational efficiency in the logistics supply chain. |

| Shyft | US / 2015 | $31.3M B | NFX, Inovia Capital, Ocean Azul Partners | Shyft is a provider of SaaS-based relocation management software. It helps in car shipment, pet moving, storage, packing supplies, moving belongings, and other services. Its AI-enabled vision algorithms & human intelligence analyze the video chat and offer inventory management functionalities as well as proof of the condition of the goods. |

| Simfoni | US / 2015 | $18M B | BOOST&Co, PeakSpan Capital | Simfoni is a digital solutions provider of spend analytics and spend automation products to leading global enterprises. Products deploy ML and AI to accelerate and automate key aspects of the procurement process, saving customers both time and money in the process. |

| Skyports | UK / 2018 | $34.2M Grant | The Freight Innovation Fund, ST Engineering Ventures Fund | Skyports is an urban air mobility infrastructure provider and drone delivery operator for aviation and managing end-to-end drone deliveries. The company designs, builds, and operates take-off and landing infrastructure for air taxis, and partners with world-class electric vertical take-off and landing (eVTOL) vehicle manufacturers to enable safe, sustainable, and efficient cargo and passenger flight operations within urban and suburban environments. |

| SmartOpt | Turkey / 2018 | — Seed | Sirket Ortağım Angel Investors Network. | SmartOpt uses statistics and AI to optimize logistics operations. It develops a platform, ForecastOpt, that predicts future demand and prices of products based on time-series methods, allowing users to analyze future market trends. |

| Southie Autonomy | US / 2017 | $7.6M Seed | Techstars, MassChallenge, BootstrapLabs, kineo finance | Southie Autonomy provides contract packagers, manufacturers, and retailers with fast and flexible robot arm automation. Their no-code, no-programming software platform makes it easy for any worker to deploy and changeover robot arms in less than 10 minutes. |

| Stargo | Israel / 2010 | $35.5M C | South Israel Bridging Fund | Stargo is revolutionizing the door-to-door quote generation process – and transforming the margin and bottom-line performance of freight forwarders in the process. Stargo generates the optimal five options for any shipment – based on route, price, preferred carrier, or time – so employees spend less time generating proposals and more time adding value to their customers. |

| Starship Technologies | US / 2014 | $197.7M B | European Investment Bank, Mercedes-Benz Group AG, Morpheus Ventures, NordicNinja VC, Taavet+Sten | Starship Technologies is a robotics company building fleets of self-driving delivery robots designed to deliver goods locally within 30 minutes. The robots drive autonomously 99% of the time to make safe and environmentally friendly curb-side deliveries from a local hub. Starships Technologies robots are equipped with a sensor suite that includes cameras, GPS and inertial measurement units. |

| Surgere | US / 2004 | $5M Convertible Note | Advantage Capital | Surgere developed a wide variety of visibility and control technologies to increase data accuracy and manage assets (packaging, parts, tools, finished vehicles) moving through manufacturing, supply chain, and logistics verticals. |

| Tachyon | Saudi Arabia / 2020 | $1.6M Pre-Seed | Tachyon develops a cloud-based platform and smartphone apps to facilitate shipping. It leverages machine learning algorithms to automatically assign trucks to the shipper | |

| ThroughPut | US / 2017 | $11M Angel | Plug and Play, Innova Memphis, Epicenter Logistics Innovation Accelerator | Developer of supply chain optimization platform designed for companies to increase output, quality, and profitability through bottleneck elimination. The company's platform provides real-time root cause analysis for end-to-end supply chain management using existing time-stamped data by leveraging powerful algorithms and practices, enabling decision-makers to take real-time corrective measures and save time, money, resources, and brand integrity. |

| Transmetrics | Bulgaria / 2013 | $7.88M | European Innovation Council | Transmetrics offers predictive optimization that helps cargo transport and logistics service providers increase their operational efficiency by applying modern technology such as artificial intelligence, predictive analytics, and computer optimization, enabling clients to improve their operational efficiency, decrease environmental impact, and cut costs through the use of modern technology. |

| Tusimple | US / 2015 | $648.1M Venture Round | Composite Capital Management, CDH Investments, SINA Corporation, Goodyear Ventures | TuSimple developed a technology for semi-trucks to build the Autonomous Freight Network (AFN) in partnership with shippers, carriers, railroads, freight brokers, fleet asset owners, and truck hardware partners. |

| Uptake | US / 2014 | $218M Grant | Revolution, Baillie Gifford, BloombergNEF, GreatPoint Ventures, Caterpillar Ventures | Uptake Technologies develops a predictive analytics platform. Its platform analyzes data to predict and prevent failures, uncover hidden profits, and discover new opportunities in healthcare, insurance, locomotives, construction, manufacturing, and other industries. |

| UVeye | US / 2016 | $195.5M D | General Motors Ventures, Hyundai Motor Company, Hanaco Venture Capital, Toyota Tsusho, Volvo Cars Tech Fund | Developer of vehicle inspection systems designed to detect threats or modifications of vehicles. The company's systems utilize high-resolution, high-speed cameras along with machine learning and computer vision to detect and identify concealed weapons and other contraband, enabling government organizations vehicle manufacturers, rental companies, and logistical centers to improve maintenance and security levels. |

| Vector | US / 2014 | $10M A | Goldcrest Capital, 8VC, Congruent Ventures Capital, 8VC, Congruent Ventures | Vector provides AI-enabled document and transport management solutions to the logistics industry. Developed a freight documentation platform designed to eliminate paperwork and automate logistics workflow. |

| Venti | US / 2018 | $37M A | LDV Partners, LG Technology Ventures | Developer of autonomous logistics mobility technology designed to develop global supply chains and industrial hubs for future transportation and moving goods. |

| VersaFleet | Singapore / 2012 | $3.5M A | SMRT Ventures, Prestellar Ventures, others | VersaFleet offers a cloud-hosted platform that includes route optimization, electronic proof-of-delivery, instant notifications, and real-time job status tracking, enabling fleet operators to manage operations in a hassle-free manner. |

| Wandelbots | Germany / 2017 | $122.2M C | Insight Partners, SAP.iO, 83North, Atlantic Labs, EQT Ventures | Wandelbots develops solutions to enable AI-driven integration of robots via smart input devices and example-based teaching. |

| We4Sea | The Netherlands / 2016 | $450K Venture Round | Mainport Innovation Fund | A cloud platform that offers solutions to monitoring platforms designed to reduce bunker costs and ship emissions. |

| Wise Systems | US / 2014 | $73.1M C | Techstars, Tiger Global Management, SAP.iO, Gradient Ventures, Dynamo | The company's software uses machine learning to automatically schedule, monitor, and adjust routes in real-time, considering multiple variables and constraints, enabling fleet managers to optimize transportation operations and make deliveries efficient at decreased costs. |

| Xeneta | Norway / 2012 | $137.2M D | Creandum, Investinor, Smedvig Capital, Alliance, Apax Digital | Xeneta is a platform provides real-time and on-demand freight rate information on all global trade routes and assists various industries in optimizing across the supply chain, recognizing the balance between getting goods to market on time and at the desired cost, enabling clients to take control of real-time and on-demand freight rate data. |

| Zinier | US / 2014 | $120M C | ICONIQ Capital, Accel, Tiger Global Management | From automated scheduling & dispatching to optimized field workflows and intelligent close-out package creation & verification, Zinier is empowering teams to coordinate and execute field service faster and more effectively. |

M&A Activity in Logistics and Supply Chain

While the investment and M&A climate has been slow for the past 18 months, there were plenty exists in the industry.

Many M&A activities in logistics and supply chain management are driven by the need for (1) digital transformation to enhance their technological capabilities in the rapidly evolving industry (2) integration of data analytics and AI to gain insights into supply chain operations, optimize routes, and enhance overall decision-making processes (3) integration of IoT devices to improve real-time tracking, monitor the condition of goods during transit, and enhance visibility across the entire supply chain (4) expansion of global reach and optimization of logistics networks to strengthen presence in key markets (5) driving sustainability as more companies focus on integrating environmentally friendly practices and technologies to meet regulatory requirements and consumer expectations.

In the table below, we summarize most recent tech acquisitions in logistics and supply chain management.

| Company | HQ / year founded | Amount Raised, $ | Deal Amount, $ | Acquirer | Deal Rationale |

| 6 River Systems | US / 2015 | $46M B | $12.7M | Ocado Group |

The 6 River acquisition was part of building up the logistics side of the business by providing automated 3PL to sellers. Ocado Group, an English grocery technology licenser, will become the robotics firm’s new parent. |

| Accelogix | US / 2012 | — | — | Spinnaker SCA | Spinnaker SCA acquired Accelogix to expand its supply chain tech. |

| Addverb | India / 2016 | $132M B | $67M | Reliance Retail | Strategic partnership with Reliance will help us deliver more advanced and affordable robots. |

| Aurora | US / 2017 | $3.7B Post-IPO | $820M | einvent Capital, T. Rowe Price | Some of the money will be invested in short- and intermediate-term investment grade instruments. It’s also possible a portion of the proceeds will go toward acquiring or investing in additional businesses, technologies, products or assets, the company wrote in a filing. |

| Berkshire Grey | US / 2013 | $428M Post IPO Equity | $375M | Softbank Group | |

| BlueNode | Canada / 2018 | $418.8M Grant | — | Everstream Analytics | Halifax-based BlueNode, which sells logistics software for the shipping industry, has been acquired by San Marcos, California’s Everstream Analytics for an undisclosed price in what BlueNode CEO Louis Beaubien has described as a bid to diversify his company into verticals outside the maritime sector. |

| ClearMetal | US / 2014 | $31M A | — | project44 | Logistics technology provider project44 has acquired competitor ClearMetal, its second acquisition in the ocean freight visibility space in three months in a market that is awash in venture investment and consolidation. |

| Clippers Logistics | US / 1992 | — | $1.3B | GXO | GXO and Clipper are both industry leaders and together they expect to accelerate growth by expanding their geographic presence in key markets and verticals, bolstering their roster of blue-chip customers and enhancing the breadth of innovative warehouse capabilities they provide |

| Coupa | US / 2007 | $405M Post IPO Equity | $8B | — | For more than a decade, we've been building an incredible Business Spend Management Community and have proudly cemented our position as the market-leading platform in our category. We're looking forward to partnering with Thoma Bravo and accelerating our vision to digitally transform the Office of the CFO. |

| DeepSea | UK / 2017 | $5.9M | — | Nabtesco | Nabtesco became the primary shareholder in DeepSea Technologies, marking further progress towards autonomous vessel development. |

| Embark Trucks | US / 2016 | $317M Post-IPO Equity | $71M | Applied Intuition | Applied aims to integrate Embark’s internal tools, data, and software assets to further improve its offerings for customers in the trucking and automotive industries. Embark plans to retire its fleet of test vehicles as part of the transaction. Key Embark employees are expected to remain to support Applied and expand the company’s suite of product offerings. |

| Envase Technologies | US / 2020 | — | $230M | WiseTech Global | WiseTech Global acquires Envase Technologies, a leading North American landside logistics software platform. |

| Fetch Robotics | US / 2014 | $94M C | $301M | Zebra Technologies | The acquisition of Fetch Robotics will accelerate our Enterprise Asset Intelligence vision and growth in intelligent industrial automation by embracing new modes of empowering workflows and helping our customers operate more efficiently in increasingly automated, data-powered environments. |

| Foxtrot Systems | US / 2014 | $9M | $4M | Descartes | Foxtrot’s advanced machine learning algorithms leverage millions of data points collected from vehicles in the field, helping customers reduce last-mile costs, improve customer service and learn service factors that improve route efficiency and on-time performance. |

| Haven | US / 2014 | $19M A | — | Fourkites | FourKites’ Dynamic Ocean solution builds on technologies gained through its acquisition of Haven, a well-established leader in international ocean shipping, document management and tracking. |

| InstaDeep | UK / 2015 | $107M B | $724M | BioNTech | The acquisition supports BioNTech’s strategy, aiming to build world-leading capabilities in AI-driven drug discovery and development of next-generation immunotherapies and vaccines to address diseases with high unmet medical needs. |

| KLD Labs | US / 1989 | — | — | ENSCO | By combining the industry’s leading inspection technologies, engineering, and service teams, ENSCO and KLD will deliver unrivaled railway inspection technology of track and rolling stock. |

| LOGYSTO | Mexico / 2022 | $2.8M A | — | Clicoh | With the acquisition of Logysto, ClicOh becomes a formidable challenger in the e-commerce and logistics space in LatAm, with a comprehensive value proposition and presence in 5 countries across the region (Argentina, Chile, Colombia, Mexico, and Uruguay). |

| Marine Performance Systems | Netherlands / 2018 | — | — | Alfa Laval | Alfa Laval announced it has completed its acquisition of Marine Performance Systems B.V. (MPS), a Rotterdam-based maritime technology company that has developed a fluidic air lubrication system enabling reduced fuel burn and emissions. |

| Nexogen | Hungary / 2007 | — | — | Transporeon | Transporeon expands its carrier offering by acquiring Nexogen, adding AI-based fleet optimization to its platform services. |

| Onalytics | Portugal / 2019 | — | — | Konvoy kegs | Konvoy, a leading international beer keg provider, has expanded its tracking operations with the purchase of Onalytics, a keg-tracking tech company based in Lisbon. |

| Pickrr | India / 2015 | $16M B | $200M | ShipRocket | Both platforms operate in the same sector, they have complementary value propositions and customer segments that will play a mutually beneficial role post the acquisition. |

| Plotwise | Netherlands / 2011 | — | — | Coolblue | Plotwise is a last-mile-focused solution that leverages ML and AI technology to improve routes and deliveries for organisations that are ready to switch from cost optimisation to service optimisation. |

| Premonition | Australia / 2015 | — | $21M | Shippit | Australian logistics scaleup Shippit has announced the acquisition of last mile technology firm Premonition for an undisclosed amount to help the Sydney-based company take advantage of the online shopping boom. |

| Shipamax | UK / 2016 | $9.5M A | — | WiseTech Global | Through CargoWise platform, company has created integrated processes to ensure data is entered only once, reducing risk of incorrect re-keyed data, time and resource effort, and costs associated with data exchange. With Shipamax, this capability extends the CargoWise ecosystem by automating the ingestion of inbound documents into operational data in CargoWise. |

| Siena Analytics | US / 2014 | - | - | Peak Technologies | The acquisition of Siena Analytics adds a critical proprietary logistics software solution to the Peak Technologies portfolio that will help customers address visibility and automation issues affecting all supply chain businesses. |

| Symbotic | US / 2007 | $405M Post IPO Equity | $405M | SoftBank Vision Fund, Walmart | Symbotic plans to accelerate growth as a public company and advance its A.I.-enabled robotics technology to transform the supply chain.

|

| Titan GPS | Canada / 2004 | — | — | GPS Insight | Certified Tracking Solutions, a leader in GPS telematics, connected transportation, and industrial IoT, today announced that it has been acquired by GPS Insight, a leading provider of SaaS-based fleet and field service management software. |

| TNX Logistics | Germany / 2016 | — | — | Transporeon | TNX's autonomous procurement service will provide a logcal enhancement of Transporeon's Ticontract tendering offering as well as its spot assignment product Transporeon Best Carrier. It will also provide an entry service to connect onto its digital platform. |

| TradeGecko | Singapore / 2012 | $17.7M | — | Intuit | Intuit's QuickBooks to acquire TradeGecko to add omnichannel commerce capabilities

|

| Turvo | US / 2014 | $91.6M B | — | Lineage Logistics | Acquisition is part of Lineage’s ongoing strategy to invest in technologies capable of transforming the global food supply chain.

|

| UiPath | US / 2005 | $1.2B E | — | IPO Mcap: $15.5B | UiPath, which is the leader in the RPA (Robotic Process Automation) market, has filed its S-1 with the Securities and Exchange Commission (SEC) this week. UiPath designs and develops robotic process automation software. The platform offers foolproof development tools, automation of intricate processes, enhanced control, cloud and on-premise deployment, robust governance, and multiple robots on a single virtual machine. |

| Voyage | US / 2017 | $51.2M B | — | Cruise | Cruise has the “most advanced self-driving technology, unique auto partners and the first purpose-built self-driving vehicle. With Voyage and our customer-service obsessed team, we’ll together deliver a game-changing self-driving product. |

| Ware | US / 2013 | $3M Seed | — | Gather AI | Gather AI acquired Ware to become the largest autonomous inventory management platform in the world. |

Remaining Challenges & Path Forward

Despite massive innovation of AI in Logistics, challenges remain, some caused by limitations of the current state of AI itself. Let’s look at the major ones:

- Training, integration, and adoption of new modern technologies

Integrating AI technology into current systems and procedures remains a future to-do task for most businesses. Many businesses are still utilizing legacy systems that may or may not be compatible with modern technology and hence will need capital and time investments to bring them up to date. While Gartner anticipates that by 2024, 50% of supply chain organizations will invest in AI applications with sophisticated analytical capabilities, organizations still face the major challenge of training and operationalizing AI systems within their business processes.

The training and tuning processes demand the caliber of tech talent which might not be accessible to SMBs. In addition, the lack of robust data and proper data management processes may further put SMBs at a disadvantage impeding their ability to fully leverage AI applications.

The stakes are even higher for those not adopting AI systems as they risk falling behind their tech-savvy competitors, making it challenging to reduce costs and meet customer fulfillment expectations.

The logistics and supply chain sector confronts intricate challenges in integrating disparate data systems across the entire chain in real time. This is crucial for agile decision-making and adaptation to dynamic market fluctuations. Technological advancement and implementation, particularly in artificial intelligence and machine learning, pose another hurdle; these technologies are crucial to optimizing logistical routes, inventory control, and predictive demand analysis but remain underexploited due to their complexity and investment requirements.

-

Ethics considerations of AI algorithms

GenAI limitations, like "hallucination", biased algorithms, and misinformation, pose ethical and reputation risks in supply chain planning. Incorrect AI outputs can result in economic repercussions, systematic discrimination, and potential lawsuits. Flawed forecasting may lead to significant economic losses. To mitigate these risks, companies must promote cross-departmental collaboration to establish policies, procedures, and controls ensuring inclusive data and quality fine-tuning of AI systems. -

Privacy and cybersecurity

Logistics cybersecurity is vital, encompassing issues like hacks, data management, GDPR compliance, and privacy laws. Integrating computer vision raises concerns about constant monitoring and potential exposure of video and image data. Organizations embracing AI in logistics need an open and proactive approach to policy and process implementation. Additionally, the connection between supply chain and national security means adversaries may target large players to infiltrate or disrupt operations, causing significant slowdowns or paralysis. -

Job replacements

AI is poised to automate manual and repetitive tasks, particularly in logistics where roles like drivers, deliverymen, and warehouse workers are vulnerable. Research indicates varying degrees of impact and timelines for such replacements. Despite job displacement, AI is expected to create new opportunities centered around facilitating, directing, and enhancing AI capabilities. The overall effect on the job market is still uncertain, but it is evident that both employees and employers must adapt and retrain. Emphasizing areas where human intelligence excels, such as strategic thinking, problem-solving, persuasion, negotiation, and interpersonal relations, will be crucial in this evolving landscape. -

Geopolitical shocks and black swans

Finally, the industry faces geopolitical risks and global challenges, with AI helping to mitigate these issues post-fact. Recent events, such as the war in Ukraine, have significantly impacted global food and drink industries, causing supply chain disruptions, shortages of key raw materials, and contributing to rising food prices and inflation.

While AI can optimize routes, forecast inventory, and aid supplier selection based on various parameters, human intervention remains crucial for navigating the complexity of major shocks and crises. For instance, manufacturers responded to war-induced disruptions by prioritizing robust logistics management, including a shift to local sourcing for resilience and cost savings. Decisions such as banning Russian products and relying on neighboring countries for gas were driven by human considerations and support for Ukraine.

Black swan events are unique and not uncommon, and AI applications currently fall short in providing comprehensive strategies for dealing with major crises. AI's limited understanding of supply chain nuances, stakeholder relationships, cultural dynamics, and the political landscape, often developed through years of industry experience, keeps humans involved in addressing complex challenges. Despite these limitations, the potential for AI to learn and adapt rapidly remains a point of interest.

In conclusion, the future of AI in logistics and supply chain management holds immense promise for efficiency, optimization, and innovation. While AI will transform various aspects of the industry, it is crucial for businesses to balance automation with human expertise. Collaboration, adaptability, and a strategic approach to integrating AI technologies will be key to navigating the evolving landscape, ensuring resilience, and unlocking the full potential of this transformative technology.

DRL Cases in Logistics & Smart Mobility

We at DataRoot Labs have helped several startups and enterprises build their AI products. Below you can read about how we used the power of AI to deliver AI-powered MVPs to logistics and smart mobility-related startups.

Have an idea? Let's discuss!

Talk to Yuliya. She will make sure that all is covered. Don't waste time on googling - get all answers from relevant expert in under one hour.

](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/populus_da0712759e.webp?fit=x1200,x800,x400,x256/width=2400)

](https://drl.fra1.digitaloceanspaces.com/drl-prod/images/origin/Starship_a79c9941c6.webp?fit=x1200,x800,x400,x256/width=2400)