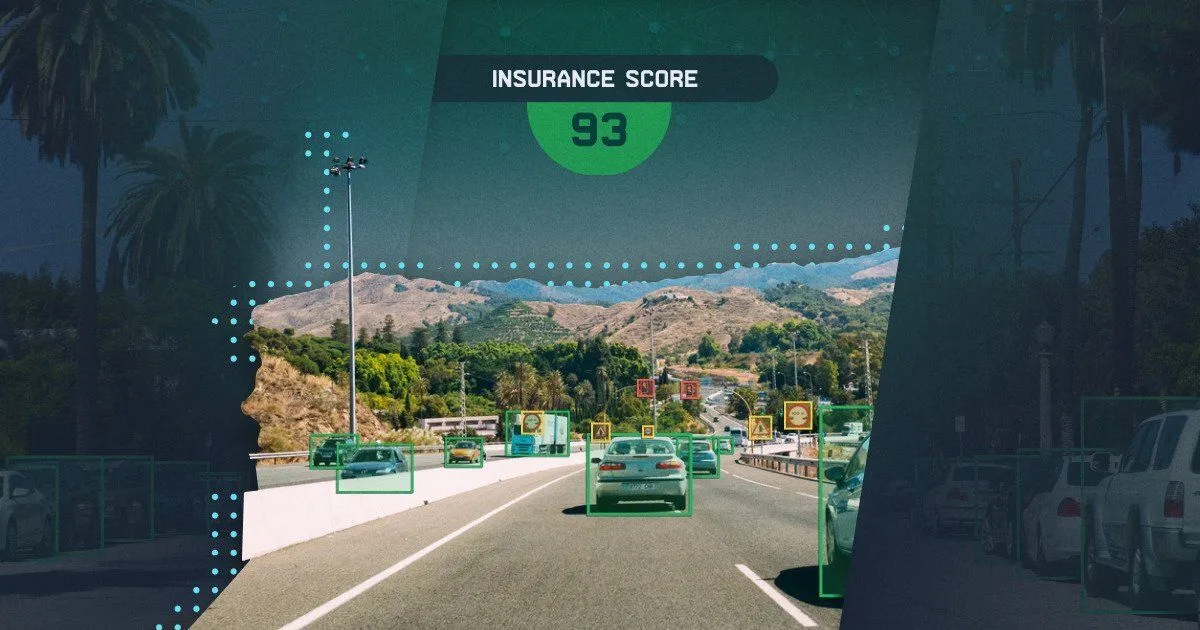

Real-time Insurance Score Modeling

Making driving safer for all traffic participants.

24 Jul 2019

5 min read

Summary

- Billions of dollars are spent annually on car insurance. While most insurance companies already segment clients based on their accidents history, drivers license score, age and other factors, none do it in real-time accounting for drivers psychotype and live behavior on the road.

- Our client is building a solution allowing insurance companies not only to update drivers credit score in real-time but also to produce driving-style recommendations to help prevent accidents.

- With the help of our team, the client built the platform using a simple smart phone and advanced Computer Vision technologies to track and adapt the insurance credit score of drivers in real-time and produce live recommendations.

Tech Stack

C++

Caffe

CoreML

Mace

Metal

Python

TensorFlow

TensorflowLite

Next Case

CV-Powered In-store Customer Behaviour Tracking

Tracking where people walk inside the store.

Timeline

1 Week

Data Labelling and Processing

Data Engineer

2 Weeks

Data Augmentation

Data Engineer

1 Week

Solution Architecture Design

Solution Architect

2 Weeks

Hypothesis Generation & Validation

Deep Learning Researcher

1 Week

Architecture Modelling

Deep Learning Researcher

3 Weeks

Training & Tuning Cycle pt.1

Deep Learning Researcher

4 Weeks

Optimization for Mobile Device

Deep Learning Engineer

4 Weeks

Training & Tuning Cycle pt.2

Deep Learning Researcher

6 Weeks

Mobile App Development

App Developer

Backend Developer

2 Weeks

CoreML / TF Lite Model Porting

Deep Learning Engineer

Tech Challenge

- We consulted the client on real-time segmentation task which runs directly on mobile phone and achieves approximately 100 FPS.

- Our team created a customized batch streaming solution to reduce the latency and produce in-batch pre-aggregations on device.

- Based on the data streamed from the phone, the solution adjusts the credit score in real-time.

Solution

- By turning a mobile phone camera into a device that tacks the road activity and collects data from accelerometer, gyroscope and GPS, the solution is able to detect cars and track their behavior in real-time.

- Based on the received data, we built the scoring model that is used by insurance companies to adjust their clients privileges.

- Additionally, the model evaluates drivers’ behavior i.e. how rational they are, and identifies their psychotype. Having classified the behavior of each driver, the solution is capable of delivering timely reports on drivers' behavior, making gamified suggestions to improve their driving style.

Impact

- DRL has delivered a working scoring model which is used as a core component of a startup’s MVP.

- The model not only helps insurance companies to prevent value destruction, but also makes driving safer for all traffic participants.

- Currently, we are assisting the startup with raising funds and launching controlled beta pilot.

Have an idea? Let's discuss!

Book a meeting

Yuliya Sychikova

COO @ DataRoot Labs

Do you have questions related to your AI-Powered project?

Talk to Yuliya. She will make sure that all is covered. Don't waste time on googling - get all answers from relevant expert in under one hour.

Talk to Yuliya. She will make sure that all is covered. Don't waste time on googling - get all answers from relevant expert in under one hour.

OR

Important copyright notice © DataRoot Labs and datarootlabs.com, 2026. Unauthorized use and/or duplication of this material without express and written permission from this site’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to DataRoot Labs and datarootlabs.com with appropriate and specific direction to the original content.