Finding the Next Unicorn with AI

How AI powers startup discovery and investment decisions.

Conventionally, investors have banked on a human intuition coupled with years of experience, to spot promising startups carrying unicorn potential. However, with ever-increasing volumes of data and acceleration in tech innovation, traditional methods are hardly sufficient to compete anymore. AI is fast becoming a game-changing differentiator. Investors can uncover key data, use the trends to predict, and find the next billion-dollar company before anyone else has seen it on the radar.

According to Gartner, more than 75% of VC investor reviews will be informed using AI and data analytics by the end of this year.

The article explores how AI changes the tech investing landscape, revolutionizing the search for the next unicorn.

Sourcing and Screening Emerging Startups

Tools: CB Insights, Crunchbase, PitchBook

Deal sourcing has always been one of the most time-consuming activities that an investment firm carries out, aiming to shortlist promising startups amidst seas and oceans of potential deals. AI automates this activity of scanning and analyzing oodles of data emanating from varied sources.

AI-powered tools decode news, articles, social media, pitch decks, financial reports, and even patent filings to bring out emerging companies that might otherwise be less well-known among classical VCs. Those tools help not only the investors in their effort to find companies earlier, but also provide real-time visibility into market movements. The level of automation and insight would let backers concentrate their time on the most promising startups based on their mandate and criteria and thus significantly accelerate the initial screening process.

Databases such as CB Insights, Crunchbase, PitchBook and others automatically conduct sourcing and screening and already have AI functional to aggregate and analyze a mammoth quantity of data about financial reports, social media activity, and industry news amongst others.

- CB Insight uses AI to analyze up-and-coming trends and technologies to identify future startups earlier.

- Crunchbase is a database of unique information on companies and markets that uses algorithms in machine learning to surface high-growth companies.

- PitchBook's enormous AI-powered database helps track the world's private capital markets for exclusive information on up-and-coming startups.

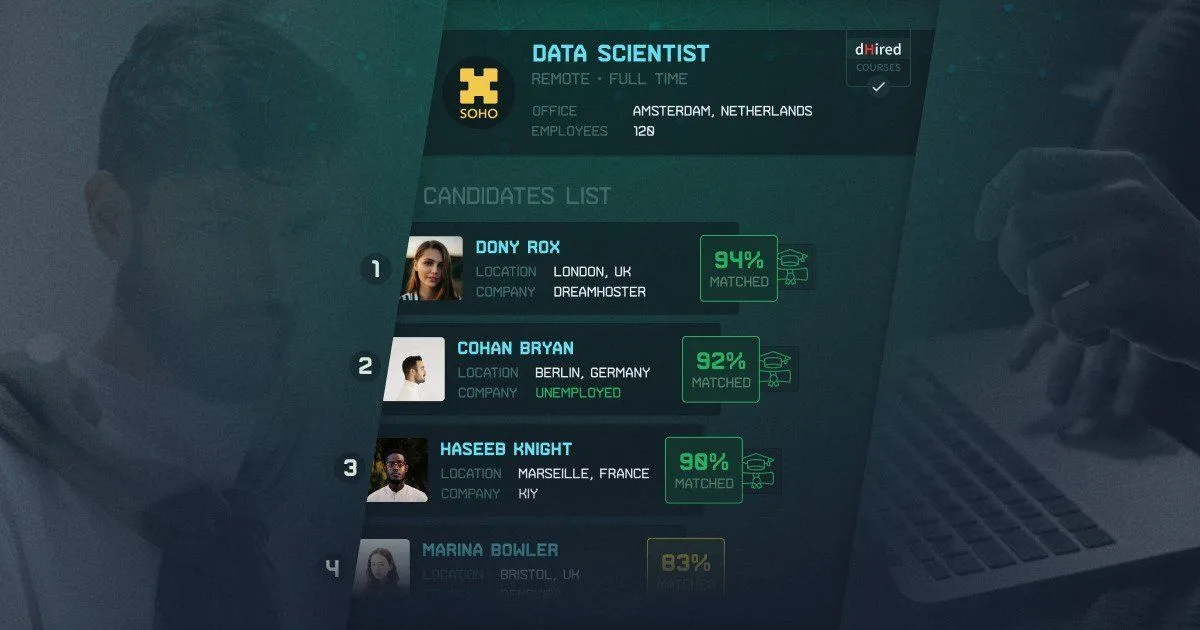

Crunchbase AI Search Builder (Beta)

The real magic, however, is in creating tools on top of these databases using multiple data sources that pre-qualify startups based on 1) the investor's mandate 2) in-depth information on the startup and founders, and 3) event triggers or activity interesting to an investor.

For example, such triggers may include:

- 2nd time entrepreneur launches a new startups.

- Startup hires a talented exec on investor's watchlist.

- startup announces a major partnership.

The important part is that such triggers should be brought to an investor's attention as soon as they are spotted for them to react swiftly. Such a tailored approach provides VCs with a head start in broadening the top of the funnel dealflow by spotting fitting companies ahead of other investors and getting their attention before others do.

Classifying Startups

Tools: Clarifai, Tegus, Kensho

Once potential investments are sourced, AI helps to classify startups into markets, stages of growth, and potential for success. AI can do much more: through the use of NLP and machine learning, classify startups based on their technological innovation all the way to customer growth and revenue models.

It gives a clear view of startups' competitive advantage and their chances of growing in the industry. This is also one of the ways VCs grade startups beyond financial parameters by gauging other key factors, like founder experience, team cohesion, and market timing, which usually determine long-term success but are hard to quantify.

These AI-run tools enable investors to assess for themselves where the startup stands, thus further verifying its potential for success:

- Clarifai, well known for image and video recognition using AI, also provides tools in startup classification through the analysis of products and technologies, to even patterns in customer engagement, by applying machine learning and natural language processing.

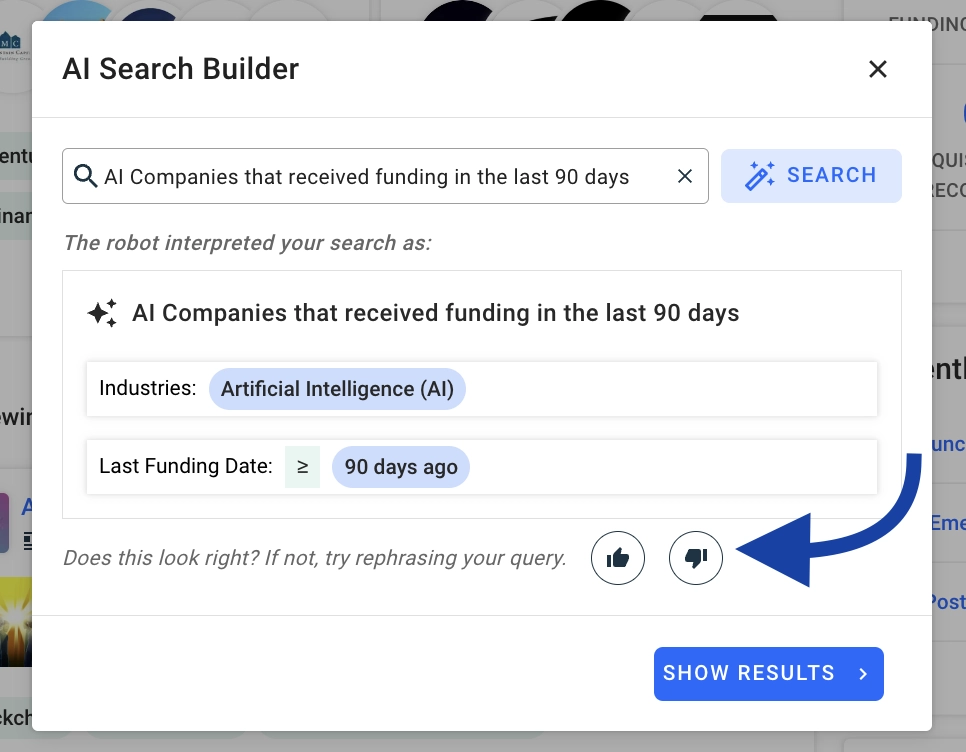

- Tegus is a platform that categorizes and evaluates startups for VCs using AI-assisted research (AskTegus) that comprises expert interviews, market data, and competitive analyses to give comprehensive insight into emerging companies.

- Kensho offers powerful AI-driven analytics to classify and evaluate startups by pulling in macroeconomic data, startup financials, and industry trends. Kensho is particularly effective in categorizing startups by their market viability and financial sustainability.

The tools will enable the shareholders to categorize the startup on many metrics to have more complete insights into growth potential and market fit.

Tegus AI-assisted Research

Monitoring Deals

Tools: Affinity, Tracxn, Dealroom

Advanced technology plays a very important role in the deal monitoring stage. Investors may leverage AI to track, in real-time, performance across portfolio companies by data analysis that pertains to revenue growth, customer acquisition, market sentiment, and even social media trends.

This will also allow VCs to raise the red flag promptly when something is going wrong, such as increasing churn rates or shrinking market share, thus enabling them to take actions before small problems snowball into bigger issues. AI tools might also provide insight into when it may be time to invest more capital or consider an exit, giving financiers an extraordinary edge in maximizing returns.

The increasing need to track and monitor the performance of a startup post-investment by VCs and investors just builds the case for better returns. AI-powered platforms like Affinity, Tracxn, and Dealroom enable backers to track portfolio companies in real-time for updates on financial performance, customer growth, and changes in market conditions.

- Affinity is a relationship intelligence platform that uses AI to enable investing firms to track their deals by monitoring communication, funding rounds, and market sentiment.

- Tracxn deploys AI to track certain key metrics like customer acquisition, market share, and technology development to provide data and insights to sponsors on startups.

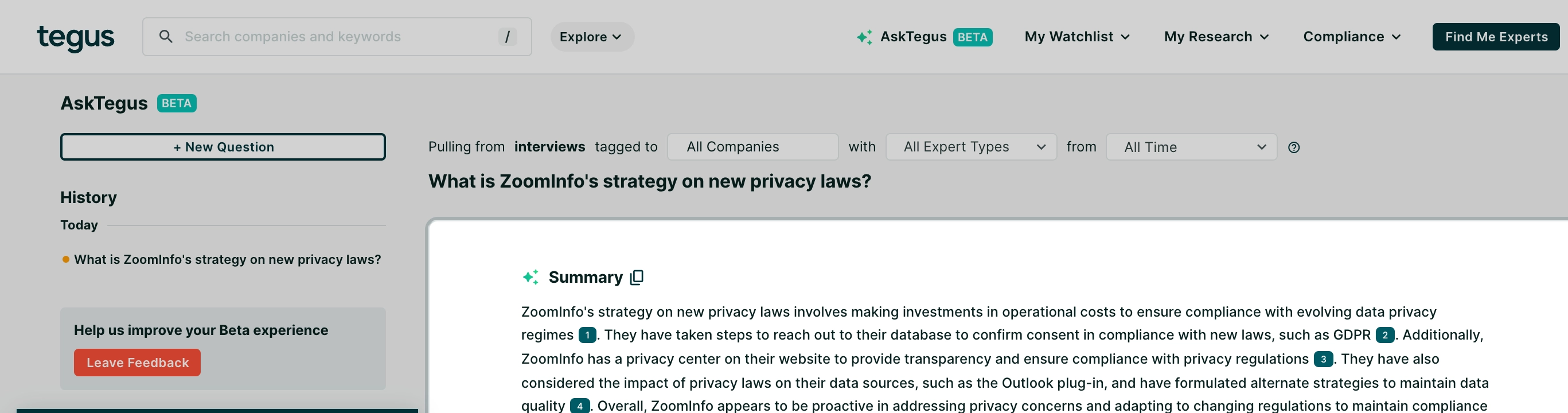

- Dealroom also has a very important role in classifying startups through AI insights into their growth perspective, market positioning, and competitive landscape. Backers will be able to screen this for things like market size, team strength, technology, and customer growth. The comprehensiveness of data on this platform enables more appropriate classification and comparison of the start-ups coming from different sectors and regions.

These tools help the investors to be ahead with their portfolio companies regarding proactive management and timely decisions, whether to invest more in them or consider an exit.

Dealroom Platform

Data-Driven Decision-Making

Tools: Visible, SignalFire

Perhaps one of the biggest differences that AI can make in investments is a transition from spontaneous to data-driven decision-making. Large datasets scrolled through algorithms running on AI algorithms to find patterns and correlations that otherwise would not have existed. From this, it can predict future market trends with the use of historical data and thus make better decisions for contributors.

AI, for example, looks at the success factors of past unicorns-funding history, customer growth rates, and founder backgrounds and checks emerging startups against this information to see if they exhibit similar traits. This makes the process even more objective and reliable because it reduces the guesswork and biases coming with traditional investment decisions.

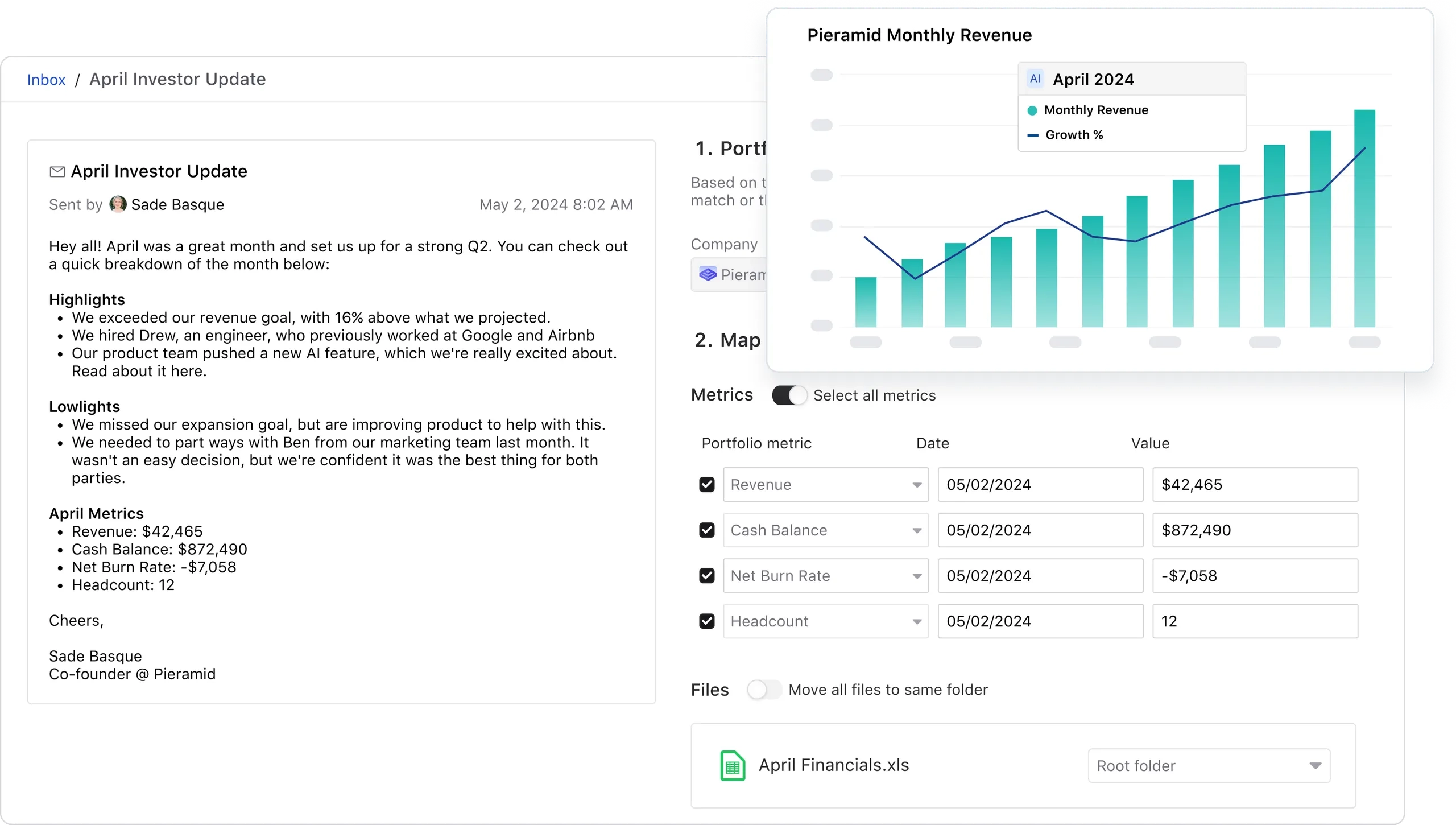

Data-driven decision-making has gradually become one of the most striking features of investments in the modern world. AI-powered tools, supporting investors to make smarter, hence better-informed decisions, include Palantir and SignalFire.

- Visible sources data directly from the portfolio of companies, analyzes it, and provides actionable insights on performance, growth, and operational milestones of that particular venture capital investment. Visible.vc supports shareholders with smart decisions concerning follow-on investments, exits, and capital allocation.

- SignalFire is an AI-driven VC platform, that renews data in real-time from 100 million sources in support of decision-making about the founder's background, product-market fit, and competitive landscape.

These platforms make sure VCs and investors avoid subjective biases and make decisions based on hard data and predictive analytics.

Parsing and Structuring Data From Email With Visible AI

Predicting Startup Success

Tools: Equidam, Mattermark

AI may play a role in predicting the future success of startups. Predictive scoring models can look at everything from growth metrics to market conditions and calculate probabilities of success based on historical trends. These predictions may continuously update themselves as new data flows in, allowing VCs to become agile in an increasingly fast-moving market.

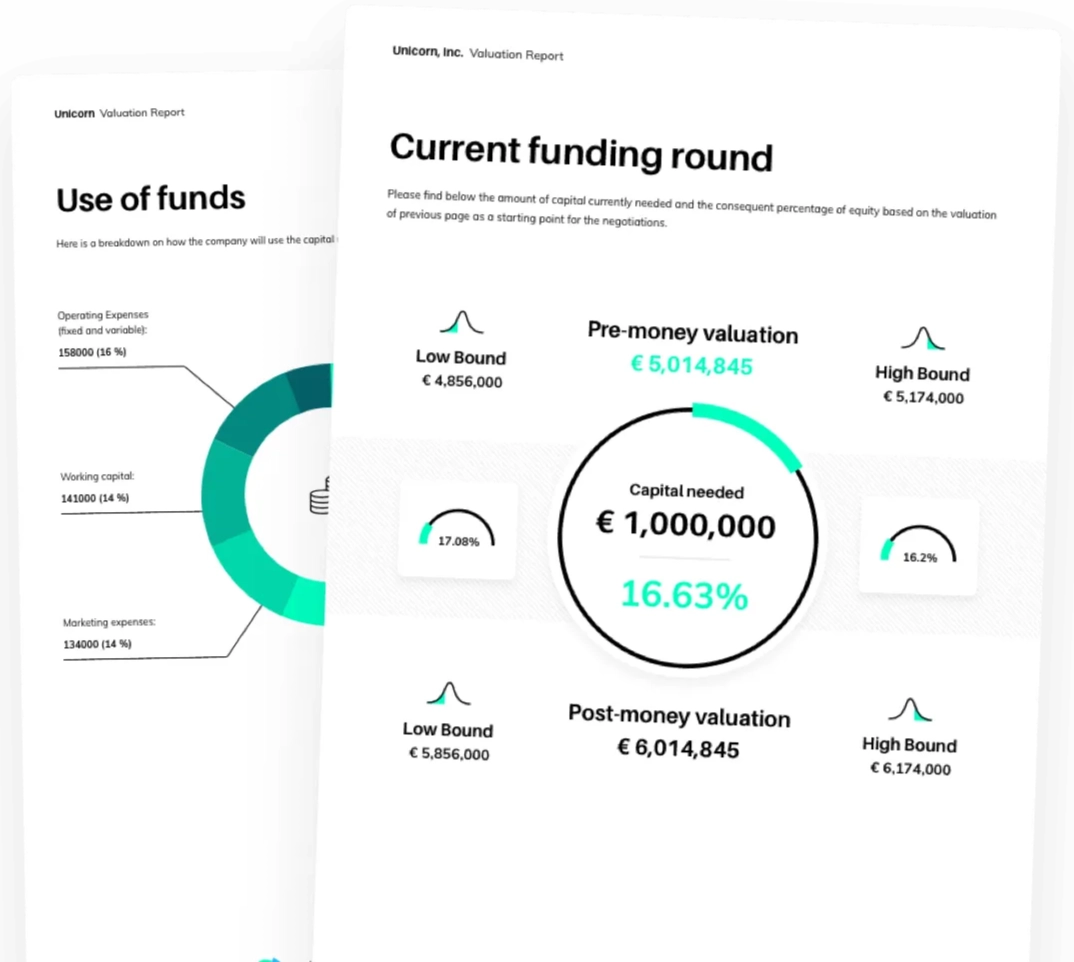

Equidam and Mattermark are among such tools that build predictive algorithms, which go through a rundown of historical data and market conditions to analyze growth in attempt to approximate startup's chances of reaching Unicorn status.

- Equidam uses AI-powered valuation models that predict startup's success based on its financial data, customer growth, and industry trends.

- Mattermark runs AI over public and private data to spot which startups are most likely to scale up based on parameters like revenue growth, funding rounds, and the strength of the team.

In other words, using these tools would enable VCs to get better at gauging investment potential and placing bets.

Equidam platform

Key Benefits

AI provides venture capitalists and other investors with a number of advantages:

- Speed and Efficiency: AI will go through large volumes of data in a very short time, therefore fastening the decision-making.

- Preciseness: With data-driven decisions, contributors would be in an appropriate position to make more accurate predictions, thus reducing the level of risks that may arise from subjective decisions.

- Early Identification: AI supports VCs in identifying emerging startups much earlier and hence can monitor their growth with far fewer missed opportunities.

- Risk Management: AI-driven tools track actual performance in real time, thereby allowing investors to reduce risk by the earlier detection of problems.

Limitations and Ethical Considerations

While AI has many advantages, avoiding limitations is not absolute:

- Algorithms are only as good as the data they get, and biases within the data lead to imperfect decisions.

- Another fear is that with too much reliance on AI, there would be an over-reliance on quantitative metrics and a reduction in the importance of human intuition, creativity, and qualitative factors that may be important in startup's success.

- In addition, some ethical issues, such as privacy and data security, are to be taken care of. Yes, the startups may deal with sensitive data; it is the VCs who need to make sure AI tools remain compliant with the right regulations and that data is handled responsibly.

What’s Next in the AI-backed Future for Investors?

As AI technology improves, the future promises to bring in better tools for market shift predictions, analysis of more intangible assets such as team dynamics, and even partial automation in the negotiation and processing of investments.

For investors, AI is still just finding its sea legs, and it's the forward-thinking investors embracing these technologies that are going to be best positioned to surface the next unicorn and ride the ever-changing landscape of the startup world.

Conclusion

One thing that cannot be denied is that AI is making tech investors faster, smarter, and increasingly data-driven. It's everything from sourcing and categorization of startups to deal-flow monitoring and predictions about success.

AI-powered tools grant VC firms unparalleled insights and opportunities - it is not an option but an absolute must to remain competitive. Equipped with AI, investors will be more likely to find the next unicorn and drive success in a market that keeps on getting complex and fast-moving.

Want to implement AI for your investment firm?

Talk to Yuliya. She will make sure that all is covered. Don't waste time on googling - get all answers from relevant expert in under one hour.